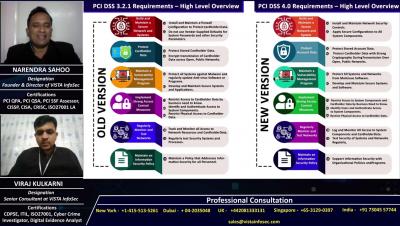

Identity and Access Management (IAM) in Payment Card Industry (PCI) Data Security Standard (DSS) environments.

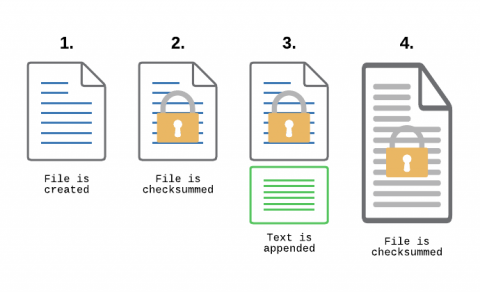

Many organizations have multiple IAM schemes that they forget about when it comes to a robust compliance framework such as PCI DSS. There are, at minimum, two schemes that need to be reviewed, but consider if you have more from this potential, and probably incomplete, list: Bottom line, in whatever fashion someone or something validates their authorization to use the device, service, or application, that authorization must be mapped to the role and privileges afforded to that actor.