Security | Threat Detection | Cyberattacks | DevSecOps | Compliance

PCI

Securing cloud infrastructure for PCI review

The PCI certification process is quite comprehensive and relates to infrastructure, software and employee access to systems, in particular to datasets and the way that they are accessed. These checks are critical not only to the wider payments industry but also to create a level of trust with users knowing their data is protected. The PCI compliance process is a number of checks, usually by an accredited third party, to ensure that secure data handling processes are in place.

Enhancing PCI compliance security with SAST and SCA

The Payment Card Industry Data Security Standard, also known as PCI DSS is a thorough process that reviews a company’s systems and policies for handling and storage of sensitive consumer cardholder data.

What is PCI penetration testing? Requirements and Benefits

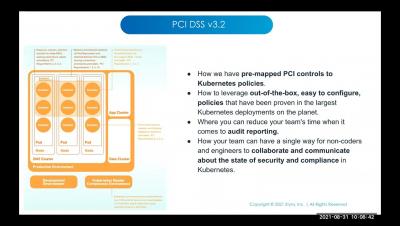

PCI Compliance in the Age of Cloud Native Tech

The Payment Card Industry Data Security Standard (PCI DSS) entered the scene back in 2004 with the rise of payment fraud. Created by leaders in the credit card industry, PCI DSS was developed to provide a baseline of technical and operational requirements designed to protect cardholder payment data and was commonly understood by those in the legacy security world.