How Cyber Security Helps Identify Internet Frauds and Crimes

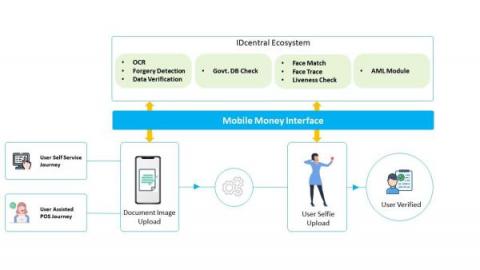

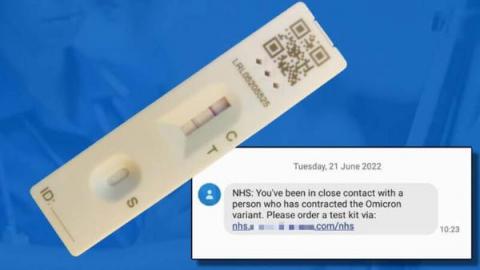

We all know that cybersecurity is an application of technologies that protect systems, networking programs, devices, and data from cyber-attacks. There are many cases of fraud reported every year. People who are using different networks want to keep themselves safe from online crime. In order to achieve this security, there is no need to heavily invest and hire computer experts; you can achieve it through cybersecurity.