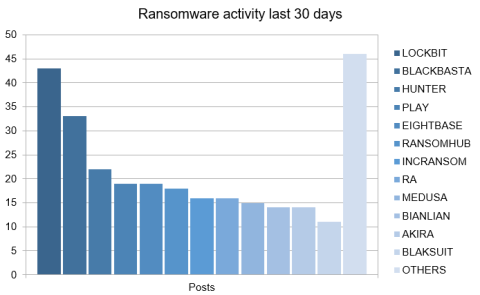

The New Ransomware Trend - Targeting SMBs

The ransomware landscape is evolving with increased competition among threat groups and the emergence of new ransomware operations. However, victim organizations and potential targets are strengthening their security measures and procedures to prepare for potential ransomware attacks. Our latest quarterly report for Q1 2024 shows a significant decrease in ransomware incidents, down to 1,048 cases, representing a 22% decline compared to Q4 2023.